Horse and Sparrow Economics: Unpacking Trickle-Down's Reality

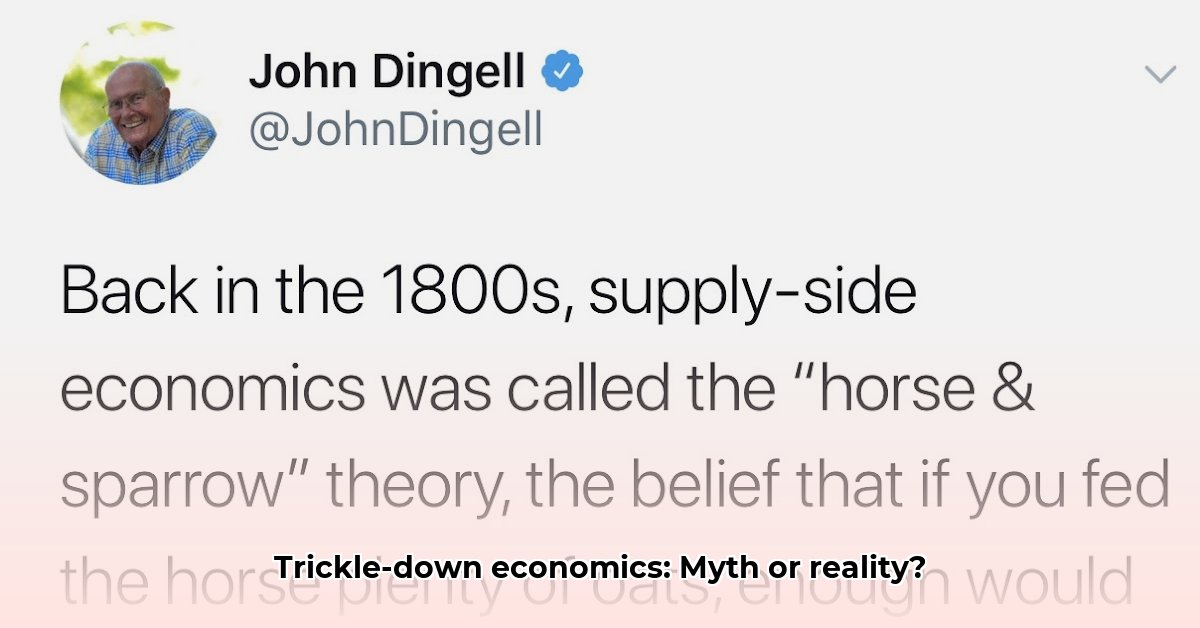

The concept of trickle-down economics—the belief that tax cuts for the wealthy stimulate widespread economic prosperity—is a persistent theme in economic debates. The idea is simple: reduce taxes on the rich, and their increased investment will create jobs and boost the economy for everyone. Think of it like a horse eating a large bale of hay; the sparrows hope some crumbs will fall their way. But does this analogy accurately reflect reality? Evidence suggests otherwise.

This article critically examines the trickle-down theory, exploring its historical application, analyzing its effectiveness, and investigating alternative economic strategies. We will delve into the complexities of measuring its impact, considering the challenges of isolating the effects of tax cuts from other economic forces.

Let's start with the analogy itself. Imagine a wealthy horse owner receiving a substantial tax cut. They might spend a little more at the local stable, benefiting a few stable hands (the sparrows). However, the vast majority of the tax savings likely remain with the horse, leaving the sparrows with minimal gains. This simple illustration highlights a critical flaw in trickle-down theory: the assumption that wealth concentrated at the top automatically translates into broad-based prosperity.

Many proponents point to the Reagan years in the US as a successful example of trickle-down economics. Significant tax cuts were implemented with the promise of stimulating economic growth and job creation. While economic growth did occur, studies reveal that income inequality increased substantially during this period. This suggests that the benefits were not evenly distributed. This pattern has been replicated in subsequent instances of significant tax cuts, raising serious questions about the efficacy of this approach.

But doesn't increased investment by the wealthy create jobs and boost innovation? Certainly, some investment does occur. However, the wealthy may not always choose to invest in job-creating ventures. Their choices can range from more investments in assets that further increase their wealth, to offshore investments that yield significant returns but don't necessarily translate to domestic job growth. Moreover, factors like automation and globalization continue to impact job markets and wage stagnation, limiting the trickle-down effect, even with increased economic growth.

Why is measuring the trickle-down effect so challenging? Several factors contribute to this difficulty. First, disentangling the unique impact of tax cuts from other economic forces (monetary policy, government spending, global events) is incredibly complex. Second, the time lag between tax cuts and their potential broader economic impact is often unclear. Third, the methods used to collect and analyze economic data have their own inherent limitations. These factors complicate the efforts to accurately assess the impact of tax cuts on different income groups.

Does trickle-down economics have any positive aspects? Some argue that it fosters innovation, as wealthy investors fund new technologies that benefit everyone in the long run. This is a plausible argument; however, the benefits may be indirect, slow to materialize, and possibly insufficient to compensate for the widening economic gaps. Furthermore, innovation isn't solely reliant on tax cuts for the wealthy.

So, what are the alternatives? Many economists advocate for policies that directly address income inequality. These include progressive taxation, robust social safety nets (unemployment insurance, affordable healthcare), and investments in education and infrastructure. These initiatives offer a more direct path toward equitable wealth distribution and economic opportunity.

The debate surrounding trickle-down economics is complex, but the central question remains: does a system that primarily benefits the wealthy truly benefit everyone? The evidence suggests otherwise. The horse and sparrow analogy, while simplistic, serves as a powerful illustration of the inherent limitations of trickle-down economics. Instead of waiting for the promise of a trickle, it's time to consider policies that deliver broader and more immediate benefits to all segments of society.

How to Measure the Actual Trickle-Down Effect of Tax Cuts

Key Takeaways:

- Trickle-down economics lacks consistent empirical support.

- While some growth may occur, benefits rarely reach lower and middle-income groups.

- Measuring the effect is challenging due to numerous confounding factors.

- Alternative strategies focusing on broader income distribution are more effective.

- Income inequality often widens following tax cuts for the wealthy.

The Horse and the Sparrow: An Economic Analogy (Continued)

The horse-and-sparrow analogy isn't just a cute story; it highlights a fundamental flaw. Studies show that the benefits of tax cuts for the wealthy often don't "trickle down" to the broader population. The wealthy tend to retain a disproportionate share of the benefits. Does increased economic activity from the top benefit everyone equally? The data suggests otherwise.

The Challenges of Measurement (Continued)

Accurately measuring the trickle-down effect is a multifaceted challenge. Identifying the unique impact of tax cuts while accounting for other economic factors requires sophisticated econometric models and careful analysis. The lag between tax cuts and observable changes in the economy adds another layer of complexity. The inherent limitations of economic data collection also impact the reliability of any conclusions.

Alternative Approaches (Continued)

Focusing on equitable distribution requires a shift in policy priorities. Investing in education, healthcare, and job training programs creates a more robust and inclusive economy. Direct financial assistance to those in need stimulates demand and fuels economic growth from the bottom up, offering a more direct and effective pathway to prosperity for all.

Analyzing Historical Data: Lessons from the Past (Continued)

Historical data, particularly from the Reagan era and subsequent similar policies, reveals mixed results. While economic growth often occurred, income inequality widened significantly. This pattern suggests that tax cuts alone may not be sufficient to guarantee widespread economic benefits. Recent examples like the Kansas experiment further underscore the risks of relying solely on trickle-down economics. Numerous studies confirm this trend.

Beyond the Numbers: Assessing Real-World Impact (Continued)

Beyond economic metrics, trickle-down economics' effect on social cohesion must be considered. Exacerbated income inequality can lead to social unrest and instability, potentially negating any purported economic benefits. A comprehensive assessment requires a holistic approach that considers not only economic growth but also social well-being and equitable distribution of resources.